How "the white lotus" exposes the trillion-dollar boom in wellness tourism

the $9 T wellness tourism paradox: luxury, tech, and cultural appropriation

This season's The White Lotus effectively depicts—with a satirical undertone, how tourism has skewed into luxury wellness. Digital detoxification, biomarker testing, and curated movement practices for the privileged few mirror current high-end wellness tourism trends.

The sector is valued at $651 billion annually and projected to reach $9 trillion by 2027 (16.6% CAGR), and is a focal point for high-net-worth folks seeking transformative health experiences, as well as investors and operators looking to capitalize on its explosive growth.

Cultural Nuances Driving Wellness Tourism Growth

The recent moon shot of tourism shows a deeper cultural shift in how people perceive health, status, and meaning. For wealthy travelers, wellness retreats aren’t just about lazing by the pool and drinking out of a coconut—but a quest for identity and exclusivity. The White Lotus sarcastically comments on digital detoxification posing as a luxury commodity, as seen by the Ratliff family being forced to lock their phones away for their trip’s duration.

IRL, resorts like Miraval and Six Senses charge premium rates for curated environments that allow guests to escape the digital world. It’s a funny paradox really, us paying for what was once the default human condition.

Wealthy guests today also crave indigenous healing practices like yoga and shamanic rituals. These practices have become thoroughly decontextualized and commodified for Western consumption, watering down their true experiential nature, bordering on cultural appropriation.

As seen by Piper, selling out on her spiritual quest at the first encounter of the "non-westernized" version of Buddhism with its dirty sheets and bland food. The show exposes the tension between marketing "authentic" experiences and preserving cultural integrity— a contradiction wellness operators awkwardly dance around while counting profits.

Wellness Tourism is Connected to Broader Trends

The wellness tourism surge stems from three convergent trends:

Preventative Health: Consumers now prioritize holistic wellbeing and preventative health over reactive healthcare.

Tech Integration: We’re not far off from a personal AI doctor traveling with us. But for now, resorts like SHA Wellness Clinic use AI analytics to personalize guest experiences based on biometrics like sleep patterns, stress levels, and nutritional markers.

Cultural Enrichment: Properties now incorporate indigenous practices (e.g., Wai Ariki Hot Springs) to differentiate themselves from competition.

These trends signal a huge shift toward measurable outcomes and transformative experiences.

Strategic Market Segmentation: Four Key Retreat Types

1. Biomarker-Driven Longevity Retreats

Market Leaders:

Canyon Ranch (Arizona): Offers comprehensive diagnostic evaluations including genetic testing and metabolic assessments, with programs starting at $15,000/week.

SHA Wellness Clinic (Spain): Uses AI to analyze sleep patterns, stress markers, and nutritional status, achieving 92% guest retention.

ROI Drivers:

Premium pricing: Programs command 30–50% higher rates than standard wellness packages.

Data monetization: Biometric data enables personalized product partnerships, generating ancillary revenue.

Consumer Implications:

Pros: Personalized health optimization with measurable outcomes (improved HRV, cortisol levels).

Cons: High costs ($10k–$25k/week) limit accessibility; potential privacy concerns.

2. Digital Detox Destinations

Market Leaders:

Six Senses (Portugal): "Sleep Wellness" programs combine device-free zones with circadian lighting, reporting 40% occupancy increases during off-peak seasons.

Miraval Resorts: Charges $1,200/night for tech-free packages, achieving 85% occupancy versus industry average of 68%.

ROI Drivers:

Low-tech infrastructure reduces capital expenditures by ~20% compared to tech-heavy resorts.

Repeat visitation: 65% of guests return within 18 months, citing improved mental clarity.

Consumer Implications:

Status signaling: 78% of HNWI guests view disconnection as a luxury indicator.

Paradox: Guests pay premium rates to experience pre-digital norms while staff remain digitally tethered.

3. Cultural Immersion & Indigenous Practices

Market Leaders:

Wai Ariki Hot Springs (New Zealand): Integrates Māori healing traditions, achieving 34% higher daily rates than regional competitors.

Amangiri (Utah): Blends Navajo traditions with Western wellness, reporting $2M+ annual revenue from curated "earth connection" experiences.

Market Tension:

Demand for authenticity versus commodification: 63% of guests prioritize "cultural respect" but resist compensating local practitioners beyond base fees.

Opportunity exists for operators who develop equitable partnerships with indigenous communities.

4. Sleep Optimization Tourism

Market Leaders:

Equinox Hotels (New York): "Sleep Sanctuaries" with hyperbaric chambers and temperature-controlled beds achieve 92% occupancy at $1,800/night.

Park Hyatt Zurich: Offers sleep-focused packages with Dreem EEG headbands, increasing winter bookings by 55%.

ROI Drivers:

High margins: Sleep diagnostics cost $150/guest but enable $500+/night premium pricing.

Partnerships: Collaborations with Oura Ring and Whoop generate 15–20% referral fees.

Consumer Outcomes:

72% report improved sleep duration; 41% experience reduced insomnia symptoms post-retreat.

Long-term efficacy remains questionable as short-term gains rarely translate to sustained habit changes.

For Investors: Strategic Opportunities

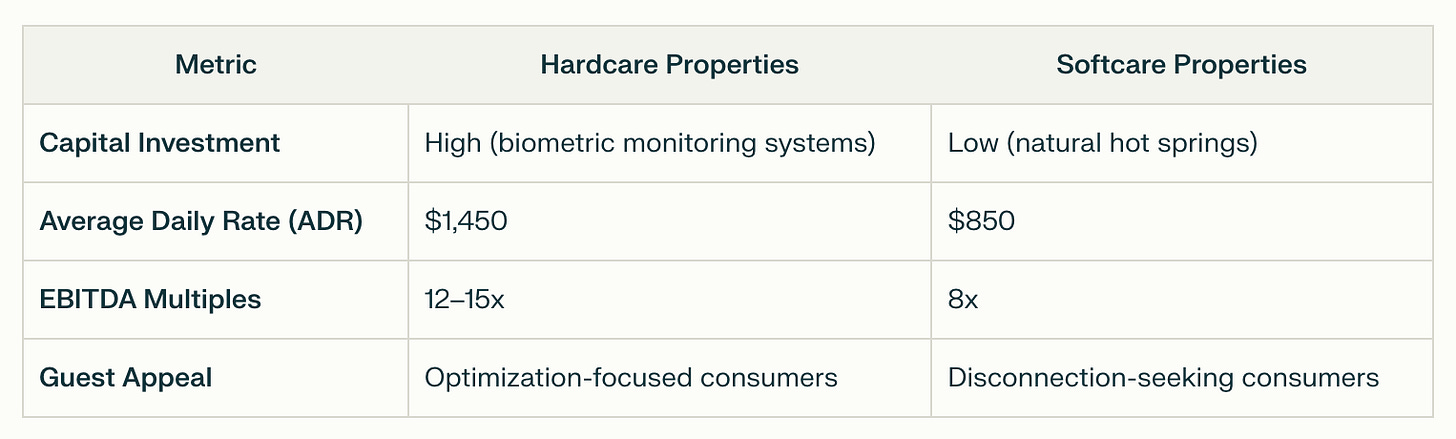

The market bifurcation between "hardcare" (technology-intensive offerings) and "softcare" (analog simplicity) creates distinct investment pathways:

Hardcare Approach: High-tech destinations like Sensei Lanai deploy biometric monitoring systems delivering quantifiable results—improved HRV or reduced cortisol levels. Tech CEOs and hedge fund managers demand these data-driven experiences to obtain measurable health benefits. These ventures command higher EBITDA multiples by monetizing proprietary data streams.

Softcare Approach: Analog retreats target consumers seeking respite from digital burnout. Natural hot springs and traditional saunas require lower capital expenditure while maintaining high margins through premium pricing strategies.

Some Key Investment Metrics:

High-Growth Segments: Sleep tourism (CAGR 24%) and longevity retreats (CAGR 19%) outperform spa-focused models (CAGR 8%).

Tech Valuation Multiples: Biometric-integrated resorts command EBITDA multiples of 12–15x versus 8x for traditional properties through monetizing proprietary data.

Sustainability ROI: Eco-certified properties achieve 14% higher ADRs than non-certified competitors by targeting environmentally conscious consumers.

For Operators: Critical Success Factors

Outcome Measurement: Guests today want quantifiable results from wellness investments. Biometric data collection drives satisfaction and enables partnerships with health-focused brands.

Cultural Integration: Authentic indigenous practices create differentiation while supporting local communities. Properties like Mana Earthly Paradise in Bali demonstrate how traditional craftsmanship + modern wellness frameworks boost perceived value.

Consumer Implications:

Accessibility Challenges: Premium retreats ($10k–$35k/stay) limit access to affluent travelers, while secondary wellness travel provides affordable alternatives.

Mental Wellbeing Focus: Post-pandemic demand surges for stress reduction and emotional resilience programs, with evidence-based approaches like sleep tourism (Equinox Hotels' $1,800/night sleep sanctuaries) leading the trend.

Status Signaling: Disconnection from technology and performance optimization programs now mark affluence among high-net-worth individuals.

~ Future Outlook

With a projected $3 trillion valuation by 2035, the wellness tourism industry shows growth potential across all segments. Success will hinge on delivering substantive wellness outcomes while navigating heightened consumer expectations around cultural sensitivity, inclusivity, and measurable results.

Investment winners will likely emerge from companies that successfully bridge technological innovation with authentic human connection—addressing the core paradox that drives this explosive market.

Data Sources: Hospitality Net, EHL Insights

Note: The 12–15x EBITDA multiples for biometric-driven hotels reflect their use of proprietary data and premium experiences. While exact multiples vary, the broader Hotels, Resorts & Cruise Lines sector trades at 13.68x EV/EBITDA, compared to 8–9x for traditional properties. This is supported by hospitality's rapid adoption of biometric technologies, projected to generate $72 billion by 2028 at a CAGR of 92%.

love this and u, and lets canyon ranch sometime soon